Money laundering has long been called a “victimless crime.” In reality, it funds terrorism, sustains human trafficking, and enables organized crime to thrive in the shadows. Traditional Anti-Money Laundering (AML) programs have relied heavily on rigid checklists, rule-based transaction monitoring, and “tick-box” compliance. Yet in 2025, the battlefield has changed and so must our defenses.

Problem with Playing Catch-Up

Criminal networks no longer pass suitcases of cash in dark alleys. They now move money through cryptocurrency mixers, gaming platforms, embedded finance apps, and even in-game NFTs. By the time a traditional monitoring system raises a red flag, the funds may have already passed through ten jurisdictions, four digital wallets, and two anonymous shell companies.

AML frameworks designed decades ago are inherently reactive — they chase what happened yesterday. Meanwhile, money launderers operate like AI-driven startups: agile, fast, and ruthlessly creative. The gap is clear — regulators are slow, while criminals iterate daily.

Rise of Predictive AML

Imagine AML systems that don’t just detect suspicious transactions but anticipate laundering attempts before they occur. This is where AI-powered behavioral analytics is making breakthroughs. Instead of focusing solely on transaction size, predictive AML examines:

- Velocity: How quickly does money move between unrelated accounts?

- Anomalies in intent: Do the transaction patterns resemble known laundering typologies?

- Digital fingerprints: Are devices, IP addresses, or typing patterns linked to multiple identities?

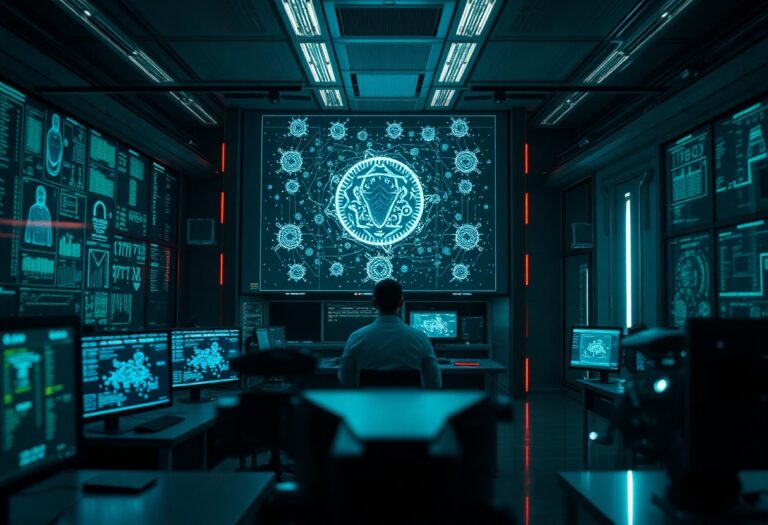

These aren’t static rules — they evolve just like fraudsters do. Think of predictive AML as cybersecurity for finance, where machine learning hunts patterns in real time.

Human–AI Fusion

AI alone isn’t a silver bullet. Overreliance can create noise, false positives, and overwhelmed compliance teams. The most innovative programs blend human intuition with machine intelligence.

For example:

- An AI system flags a cluster of microtransactions across multiple e-wallets.

- A human analyst identifies that these accounts belong to freelancers in a gig economy app — not criminals.

- The system learns from this judgment, reducing false positives in future reviews.

This feedback loop represents the next generation of AML orchestration — machines detecting the invisible, humans providing context.

Next Battleground: Invisible Money

Here’s the twist: the future of laundering may not involve traditional “money” at all. Consider:

- Loyalty points exchanged across platforms.

- In-game currencies traded in metaverses.

- Carbon credits manipulated to conceal illicit flows.

Tomorrow’s AML programs must expand their radar beyond bank accounts and crypto wallets to include every digital token carrying transferable value.

A Cultural Shift: From Policing to Protecting

What if AML stopped being viewed as a compliance burden and became a customer trust advantage? Imagine banks advertising:

“Our AI-driven AML doesn’t just meet regulation — it ensures your money never mixes with crime.”

This reframes AML from a cost center to a value proposition. In an era where customers demand ethical finance, the institution that can prove “clean money” will win the trust war.

Closing Thought: AML as Cybersecurity for Society

At its core, money laundering is the operating system of crime. Stop the laundering, and you defund criminal ecosystems at scale. The next wave of AML innovation isn’t about filling forms for regulators — it’s about outsmarting launderers, protecting digital economies, and safeguarding trust.

The fight against money laundering is no longer about compliance. It’s about resilience, intelligence, and staying one step ahead of the shadows.

Key Takeaway:

Anti-Money Laundering in 2025 isn’t about catching the past — it’s about predicting the future.