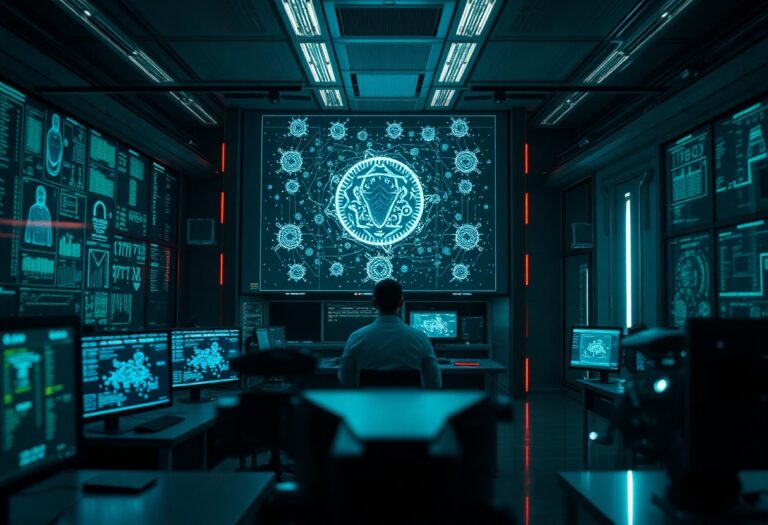

“SOC: Securing Systems, Stopping Sabotage”

Financial Sector without SOC and Cybersecurity

Digital disruption is driving positive changes across the financial sector, especially with the growing demand for mobile banking services. However, the evolving threat landscape also increases cybersecurity breaches due to lack of SOC. Many financial institutions rely on outdated infrastructure instead of SOC to store sensitive data, making them prime targets. For example, a 2025 cyberattack on a bank exposed sensitive client financial records.

Despite significant financial losses from cybercrime, are we doing enough to prevent these threats?

Without an SOC, Financial Institutions Face Multiple Cyberattacks

Ransomware Attacks occurring due to Absence of SOC

Ransomware is malicious software designed to hold sensitive data or systems hostage, demanding ransom (often in cryptocurrency) for release. Ransomware can cause massive financial damage, especially in the banking sector.

Types of Ransomware

Types of ransomware include the following:

-

- Encryptors

- Lockers

- Scareware

- Leakware

- Ransomware as a Service (RaaS)

A notable ransomware attack targeted an insurance firm, where the attackers threatened to leak vast amounts of data unless an undisclosed ransom was paid.

Data Breaches

Data breaches occur when sensitive information is accessed or leaked without authorization. Adversaries often steal customer data from banks to sell on the black market for profit. A recent breach compromised account details, customer statements, and sensitive information from a prominent bank.

Insider Threats

Insider threats involve individuals—current or former employees, clients, or partners—misusing authorized access to harm an organization. Motivations may include job dissatisfaction or personal gain. Insider threats are particularly dangerous in financial institutions, where employees may inadvertently or deliberately participate in fraud or data theft.

One infamous banking fraud revealed employee involvement, either through ignorance of modern cyber threats or malicious intent.

Role of SOC in Preventing Cyber Threats

Cyberattacks in the financial sector can disrupt economic growth. Implementing an effective Security Operations Center (SOC) helps prevent these threats and reduces their impact and cost.

Key SOC Strategies for Preventing Ransomware

- Endpoint Hardening: SOC teams continuously monitor endpoint devices to detect ransomware threats and address vulnerabilities before they escalate.

- Threat Intelligence: SOCs gather intelligence from reliable sources to stay ahead of modern attack techniques. Learning from past data breaches helps prevent similar future incidents.

- User and Entity Behavior Analytics (UEBA): SOCs use UEBA to analyze user behavior, detecting anomalies like unauthorized access after hours or former employees logging in post-resignation. Early detection of abnormal behavior helps prevent insider threats and strengthens security.

How should organizations prioritize cybersecurity? Share your thoughts in the comments!